Why Join Us

Founded as a pharmaceutical company, we are equipped with practical experience and business expertise in biotechnology. Our familiarity with the industry value chain and ecosystem, along with complete expert network and resource integration capabilities, make us the most professional biotechnology incubator platform in Asia Pacific.

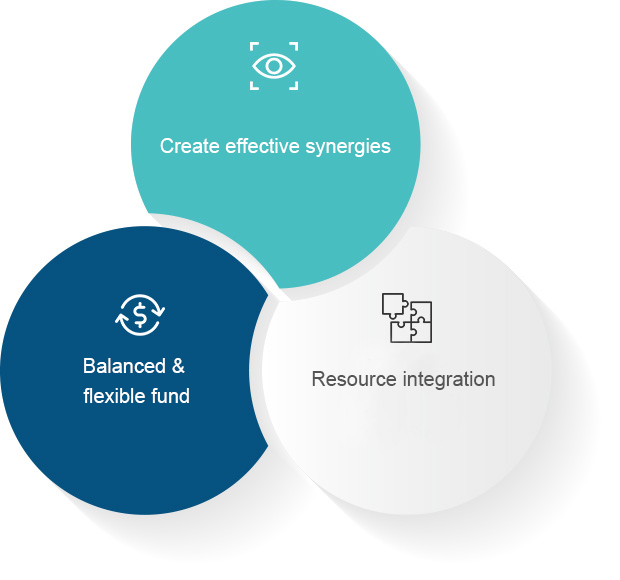

Strategy

Create Effective Synergies

By targeting biotechnology and healthcare industries, we are actively identifying and exploiting corporate synergies to enhance overall competitiveness. We are simultaneously exploring the development of the industry to grasp the future trend.

Balanced & Flexible Fund

Committed to risk control and cash flow sustainability, we continuously optimize our investment portfolio and improve our investment efficiency.

Resource Integration

In addition to integrating international resources, we provide our portfolio companies a platform for sharing resources and knowledge that complement each other, which helps nurture future talents.

Expertise

-

Early Or Reorganization Stage Investments

Based on our superior knowledge of the trends and needs in the biotechnology industry, we accurately select companies and support its growth starting from the early stages. We also tend to invest in high barriers traditional industries that are undergoing reorganizations.

1

-

Long-Term Investments With High Profits

As the field of biotechnology is characterized by longer investment period, our professional and accurate judgment allows us to invest early when the capital burden is low and profit multiplier will be high if successful.

2

-

Dedication To Post-Investment

Unlike venture capitals, we are a corporate venture that provides resources and guidance to help portfolio companies set long-term business goals.

3

With deep industry experience and specialized commercialization capabilities, we help portfolio companies modify strategies as well as embrace differentiated market positioning and innovative business models. Our tactics—pre-investment assessment, post-investment management, strategic focus, and well-designed exit strategy—allow us to select and manage investments that maximize returns.

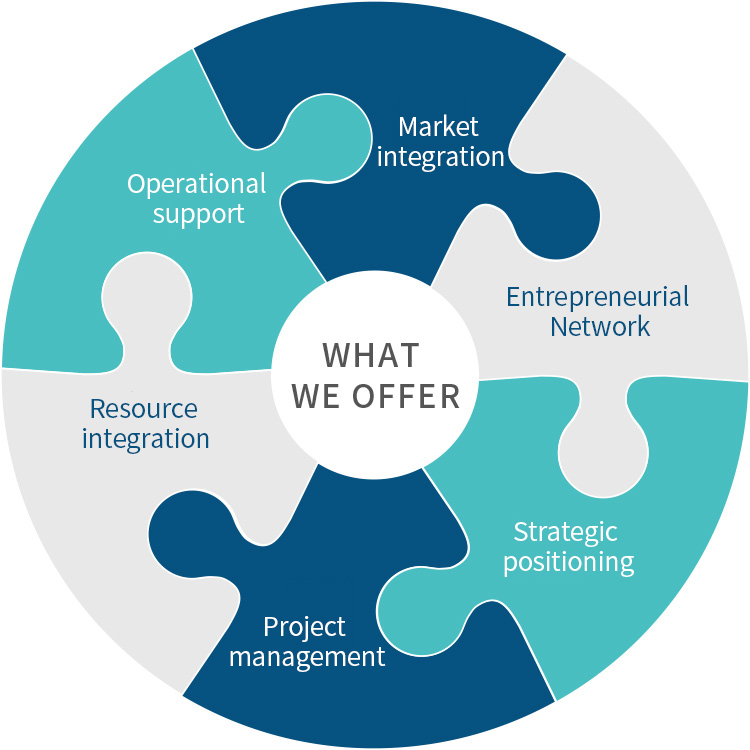

We Provide Six Core Sources Of Values To Our Companies

-

Market Integration

We assist entrepreneurs to commercialize innovative and high-potential ideas that meet market demands.

-

Entrepreneurial Network

Get up close with world-class experts and accumulate knowledge, experience, and valuable connections.

-

Strategic Positioning

We routinely guide companies to review and reposition future development direction to retain competitive edge.

-

Project Management

Depending on the project’s needs, we provide one-stop services that complement portfolio companies’ core competencies in areas such as regulatory affairs, clinical trial design, license-in/out negotiation, and business development.

-

Resource Integration

Assisting companies in raising funds, identifying strategic partners, and matching required resources.

-

Operational Support

We offer financial, legal, tax, human resources, IT and other company operational infrastructure support.

Track Record

-

US$1.0+B

Assets Under Management(*2024Q2)

-

40%

Liquid Assets

-

25+

Portfolio Companies

-

14

IPOs